A Midwestern city facing a large deficit with deferred maintenance decided to sell off a public asset for over $1 billion dollars. Sound familiar? This story is not only about the Cincinnati Rail Sale, but a similar situation with Chicago parking meters in 2008. The Chicago story did not end well – a cautionary tale of the worst privatization deal in U.S. history and why public goods should stay public.

Cautionary Tale: Chicago Parking Meter Sale

Fifteen years ago, Chicago sold its 36,000 parking meters to a private company for $1.15 billion. In exchange, the company would have a 75 year lease on the parking meter revenue. It wasn’t until the ink was dry on the contract that the finer details came into focus. The city’s inspector general concluded that the meters had been sold for $1 billion dollars under value. And because the company demanded a healthy return on their investment, parking rates increased to some of the nation’s highest. By 2019, just ten years into the 75 year lease, the company had made back their initial $1.15 billion investment plus $500 million in profit from parking meter revenue. The Chicago-Sun Times estimates that by the end of the lease, the company will make 6X more profit than its original investment, totaling nearly $7 billion.

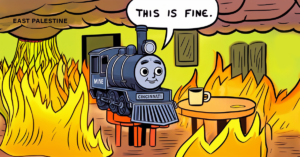

Critics have compared the deal to payday loans and criticized city leaders for rushing the sale. “They were so short-sighted. They took the quick cash, ignoring the fact that they were saddling the city with terribly structured, undervalued deals that will cost the city for decades to come,” said attorney Clint Krislov, director of IIT Chicago-Kent’s Center for Open Government Law Clinic in an interview with the Chicago-Sun Times.

It was an “incredibly stupid way” to borrow money on the city’s future revenues, agreed Donald Cohen, executive director of In the Public Interest and author of The Privatization of Everything.

Chicagoans have since tried to terminate the 75 year lease and take back their parking meters, however judges have ruled in favor of the private company. Most recently in April 2023, 7th U.S. Circuit of Appeals Judge Diane Wood wrote, Chicago had “authority to enter into this arrangement” and “The deal itself might have been foolish, short-sighted, or worse, and if one is to believe news reports, it may have saddled Chicago with the most expensive street parking in the country, but that is not enough to state a claim for a violation of the antitrust laws.”

Cincinnati received financial incentive to rush the Rail Sale

On November 7, Cincinnati voters will have a say on whether their public good, the Cincinnati Southern Railway, will be sold off to a private company for $1.6 billion. Similar to Chicago, city leaders have been rushing the sale after being offered a $5 million incentive from the buyer, Norfolk Southern, to rush to put the issue before voters in November 2023 and close the deal by December 31, 2023, according to the sale application in the federal register (Document 306778, p. 15, Section 2.04.a.i. “Accelerated Transaction Fee.”) The $5 million includes an additional $500,000 paid to the CSR Board of Trustees on June 28, 2023 to “cover certain expenses of the Trustees in connection with the transaction.” (Document 306778, cover letter). The accelerated transaction is set to take place two years earlier than the current lease expiration date in 2026.

The Accelerated Transaction Fee draws into question the financial transparency of city leaders who have assured that Norfolk Southern is funding the “Sell The Railway” campaign and the city is not involved. Recently, an investigative report by WCPO-TV revealed that the “Sell The Railway” campaign shares the same treasurer and media strategist as Cincinnati Mayor Aftab Pureval’s re-election campaign. When asked, the mayor gave the wrong name of his treasurer. The mayor was the face of television commercials for the “Sell” campaign; after the investigative report the advertisements were pulled from broadcast for conflict of interest.

What’s at stake?

Cincinnati Southern Railway, which has been owned by the City of Cincinnati since 1869 and has been a reliable source of revenue for over 150 years. The city currently receives around $25 million a year from the lease with Norfolk Southern, which makes up 42 percent of the city’s $60 million annual capital budget. The lease agreement, last renegotiated in 1987, is set to expire December 31, 2026, with a 25-year renewal option. Citizens are leading a bipartisan campaign opposing the sale, sounding the alarm that – similar to the Chicago parking meters – the railway purchase price has been undervalued and the sale is being rushed.

In 2021, Norfolk Southern sold 28 miles of its railroad to Virginia Passenger Rail Authority to increase Amtrak service throughout the state. When calculating the price per mile of Cincinnati Southern Railway, a $1.6 billion offer for a 336-mile railroad is $4.76 million per mile of railroad – roughly half of the Virginia rail sale two years prior. Using the valuation from Virginia of $9.17 million per mile of railroad, Cincinnati Southern Railway should be valued at $3.08 billion.